Introduction

Did you know the average U.S. wedding cost in 2021 was over $30,000? Planning your dream wedding shouldn’t require breaking the bank.

- Importance of Savings Plans: With rising wedding costs, having a robust savings plan is more crucial than ever. This plan not only ensures financial security but also lets you enjoy your big day without monetary worries.

- Outline: This article explores various wedding savings strategies, offers practical budgeting tips, showcases real-life success stories, and provides a comprehensive FAQ section to help you plan your wedding efficiently

Understanding Wedding Budgets

- Expenses Overview: Detail common wedding expenses from venue rentals to catering and photography.

- Influencing Factors: Discuss how location, season, and guest count impact overall costs.

- Setting a Budget: Tips on how to set a realistic and manageable budget based on personal financial situations.

Types of Wedding Savings Plans

- Savings Strategies: Explore fixed monthly savings, percentage of income plans, and other savings approaches.

- Pros and Cons: Evaluate each strategy to help readers choose the best plan according to their financial habits and goals.

Tips for Maximizing Your Wedding Budget

- Cost-Saving Tips: Discuss how choosing an off-season wedding date or a less popular day of the week can significantly reduce costs.

- Budget Allocation: Offer advice on prioritizing spending on key aspects like venue and catering while finding savings in areas like decorations and favors.

Financial Tools and Resources

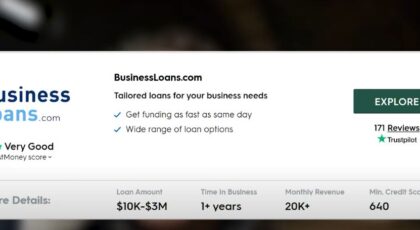

- Budgeting Apps: Introduce apps and tools that can help couples track their wedding expenses.

- Expert Partnerships: Highlight services from financial planners specializing in wedding budgets, possibly featuring a partnership link for further consultation.

Real-life Success Stories

- Testimonials: Share success stories from couples who successfully managed their wedding budgets.

- Inspiring Advice: Through these narratives, offer actionable tips and encouragement to readers.

FAQ Section

- What is the first step in creating a wedding savings plan?

- Start by understanding your total budget and prioritize your most important expenses.

- How much should I save monthly for my wedding?

- This depends on your total budget and timeline, but aim to save 20% of your monthly income towards wedding expenses.

- Are there specific financial tools for wedding planning?

- Yes, many budgeting apps offer wedding-specific features for tracking expenses and savings.

- Can I have a beautiful wedding on a tight budget?

- Absolutely! Focusing on what truly matters to you and making cost-effective choices can lead to a memorable celebration.

Follow Me