Options for Business Structure When Not Using an LLC: Non-Corporate Business Operation: Risks of Operating Without an LLC: Conclusion:While initiating a business without an LLC can be straightforward and economical, it exposes you to significant personal liability and operational difficulties. …

Stacie Saunders Articles.

PURE (Privilege Underwriters Reciprocal Exchange) Insurance specializes in offering high-value insurance products tailored for affluent individuals and families. Known for its member-focused approach, PURE aims to provide comprehensive coverage and exceptional service. Types of Insurance Offered Key Features Conclusion PURE …

OverviewAIG Private Client Group offers comprehensive insurance solutions tailored to high-net-worth individuals. Their policies provide extensive coverage for homes, automobiles, art, and private collections, ensuring that clients’ valuable assets are well protected. Coverage Details Customer Experience AIG Private Client Group …

High Value Home Insurance: Protecting Your Most Valuable Asset High value home insurance is a specialized form of homeowners insurance designed for properties valued at $1 million or more. It provides coverage that goes beyond standard home insurance policies, offering …

The Costs of Saying “I Do”: Comparing Wedding Expenses in New York, California, and Florida Introduction Planning a wedding is an exciting, albeit daunting, task for many couples. The location of the wedding can significantly influence the overall expenses involved. …

Introduction Did you know the average U.S. wedding cost in 2021 was over $30,000? Planning your dream wedding shouldn’t require breaking the bank. Understanding Wedding Budgets Types of Wedding Savings Plans Tips for Maximizing Your Wedding Budget Financial Tools and …

In the fast-paced business environment of today, the capacity to get money in a short amount of time can be the deciding factor in whether or not a fresh opportunity is properly capitalized on or if it is completely missed. …

The Step-by-Step Guide to Obtaining a Loan of $5 Million for Your Company The acquisition of a loan for five million dollars is a huge financial venture for any company, and it necessitates extensive preparation, a solid credit history, and …

How to Secure a Commercial Property Mortgage: Essential Tips and Strategies Introduction Securing a commercial mortgage is a pivotal step for real estate investors, small business owners, and commercial developers. It not only enables the acquisition of property but also …

Choosing the Best Commercial Real Estate Loan: A Complete Guide Preface For investors and entrepreneurs alike, getting a commercial real estate loan is a crucial first step in the development and expansion of their businesses. In addition to making it …

Navigating the Path to Securing a Commercial Mortgage: A Comprehensive Guide Introduction In the realm of business finance, securing a commercial mortgage represents a pivotal step for business owners looking to purchase, develop, or refinance commercial property. A commercial mortgage …

Choosing the Right Commercial Property Lender: A Guide to Making Informed Decisions I. Introduction The journey to acquiring commercial real estate is paved with critical decisions, of which selecting the appropriate lender stands paramount. The right commercial property lender not …

I. Introduction Small Business Administration (SBA) loans offer a lifeline for entrepreneurs and investors looking to delve into commercial property investments. Designed to foster small business growth, these loans stand out for their accessibility and advantageous terms compared to traditional …

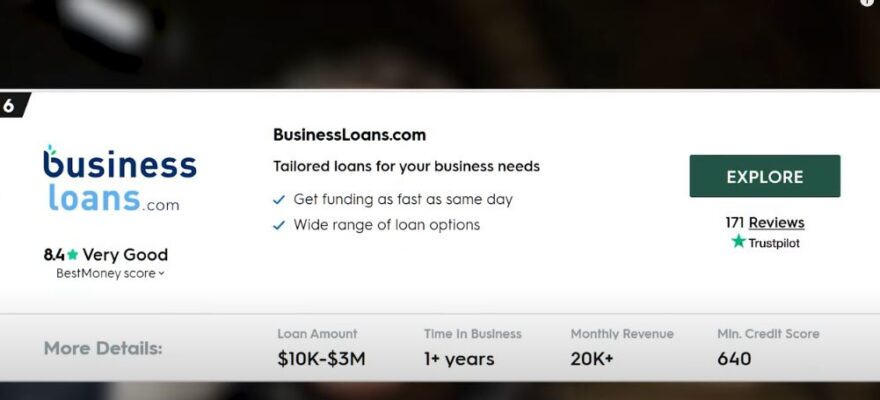

The Ultimate Guide to Fast Business Loans: Securing Quick Financing for Your Business In today’s fast-paced business environment, having access to quick financing can be the difference between seizing opportunities and falling behind competitors. This guide provides an in-depth analysis …

In the ever-evolving landscape of the mortgage industry, non-Qualified Mortgage (non-QM) lending emerges as a vital solution, offering flexibility and accessibility to a diverse range of borrowers. This long-form article delves into the intricacies of non-QM lending guidelines, aiming to …

In today’s dynamic real estate market, homeowners are increasingly looking towards refinancing options as a strategic way to unlock their home’s equity for improvements and upgrades. This guide provides an in-depth look into how refinancing for home improvement can not …

Refinancing your home can be a powerful tool to improve your financial situation. This guide delves into the myriad benefits and considerations of home refinancing, providing you with the insights needed to make an informed decision. Home Refinance Benefits: A …

Introduction In the realm of home financing, conventional mortgages have stood the test of time as a reliable option for prospective homeowners. In this comprehensive guide, we delve deep into the intricacies of conventional mortgages, shedding light on their inner …

When it comes to purchasing a home in the beautiful state of Florida, one of the financing options that often stands out is the Federal Housing Administration (FHA) home loan. FHA loans are designed to make homeownership more accessible, particularly …

If you’re dreaming of homeownership in the Garden State, you’re in the right place! Discover how FHA lenders in New Jersey can make your dream a reality. FHA Lenders New Jersey: An Introduction When it comes to buying a house …

Introduction Purchasing a home is an exciting milestone in anyone’s life. However, the financial aspects of homeownership can often seem overwhelming. That’s where the Federal Housing Administration (FHA) steps in with their home loan program tailored specifically for Florida residents. …

Finding the right FHA lender in Florida can be a daunting task. The options are vast, the details can be complex, and you’re tasked with finding the most reliable and cost-effective option. Fear not, we’ve created this all-encompassing guide to …

If you’re looking to buy a home, you may have heard about FHA loans. The Federal Housing Administration (FHA) provides mortgage insurance on loans made by FHA-approved lenders, making it easier for individuals with lower credit scores or limited funds …

Introduction Welcome to our comprehensive guide on FHA loans, where we delve into the world of affordable homeownership opportunities and how you can benefit from this popular mortgage option. At [our company name], we understand the importance of finding the …

Buying a home is a significant investment, and obtaining a mortgage is often an essential step in the process. When you’re ready to apply for a mortgage, it’s essential to ask your lender the right questions to ensure you’re getting …

Obtaining a mortgage can be a crucial step toward homeownership. However, not everyone will qualify for a mortgage due to various factors that lenders consider when assessing a borrower’s ability to repay the loan. This article will explore the factors …

Introduction If you’re considering buying a home in the Sunshine State, getting a mortgage will likely be a crucial part of the process. Florida offers a variety of home loan options and navigating the mortgage landscape can be challenging for …

When it comes to buying a home, many people struggle with the challenge of saving up enough money for a down payment. This is where FHA loans come in. An FHA loan is a mortgage that is insured by the …

4 min read. Jan. 21st. 2023, by Stacie Saunders When it comes to buying or selling property, the terms “title” and “deed” are often used interchangeably, but they actually refer to different things. Understanding the difference between a title and …

3 min read. Jan. 21st. 2023, by Stacie Saunders A loan officer is a professional who works for a financial institution, such as a bank or credit union, and is responsible for evaluating and approving loan applications. Their duties include …

Indirect funding and direct funding are two different methods of funding a project or venture. Indirect funding refers to funding that is provided to a project or venture through intermediaries, such as banks, venture capital firms, or crowdfunding platforms. This …

What is a jumbo loan and when do you need one? A jumbo loan is a type of mortgage loan that exceeds the conforming loan limits set by government-sponsored enterprises Fannie Mae and Freddie Mac. These limits vary depending on …

A mortgage lender is a financial institution that provides loans to individuals and businesses for the purpose of purchasing real estate. These lenders offer a variety of mortgage products, including fixed-rate and adjustable-rate mortgages, as well as a range of …

A reverse mortgage is a financial tool that allows homeowners to borrow money against the equity in their home. It is called a “reverse” mortgage because instead of making monthly payments to a lender, as with a traditional mortgage, the …

Follow Me