Choosing the Right Commercial Property Lender: A Guide to Making Informed Decisions

I. Introduction

The journey to acquiring commercial real estate is paved with critical decisions, of which selecting the appropriate lender stands paramount. The right commercial property lender not only influences the terms of your loan but also plays a crucial role in the financial health and success of your investment. This introduction underscores the importance of meticulous lender selection, emphasizing the need for a lender that aligns with your investment goals and financial capabilities.

II. Quality #1: Transparent Terms and Conditions

Transparency in loan terms and conditions is foundational in a lender-borrower relationship. Clear, straightforward loan agreements foster trust and ensure that borrowers fully comprehend their obligations, rights, and the total cost of the loan. The Federal Trade Commission (FTC) outlines guidelines on commercial lending practices, advocating for transparency and fairness, which borrowers should familiarize themselves with to make informed decisions (FTC guidelines on commercial lending).

III. Quality #2: Competitive Interest Rates

The impact of interest rates on the overall cost of a loan cannot be overstated. Competitive rates can significantly reduce the financial burden on the borrower, enhancing the investment’s profitability. Understanding what constitutes a competitive rate requires insight into the current market trends and factors influencing commercial mortgage rates. An in-depth guide can equip borrowers with the knowledge needed to navigate this aspect (A guide to understanding commercial mortgage rates).

IV. Quality #3: Flexible Loan Structures

The diversity of commercial real estate investments necessitates a lender capable of offering flexible loan structures. Such flexibility allows for tailored financial solutions that accommodate varying project scales, risk profiles, and timelines, thereby maximizing the potential for borrower success and satisfaction.

V. Quality #4: Strong Reputation and Reliability

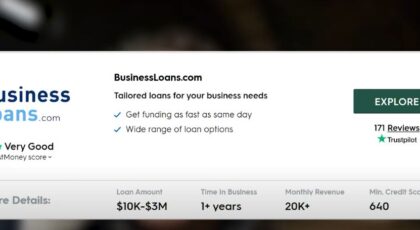

A lender’s reputation for reliability and ethical practices is a cornerstone of trust and security in a financial partnership. Prospective borrowers should conduct thorough research into a lender’s track record, seeking out reviews and ratings on reputable financial industry watchdog sites to gauge the lender’s standing in the community and its commitment to supporting its clients.

VI. Quality #5: Additional Services and Support

Beyond financing, the best commercial lenders offer value-added services such as educational resources, financial advice, and responsive customer support. These services can significantly enhance the borrower’s ability to make informed decisions, navigate the complexities of commercial real estate investment, and achieve long-term success.

VII. Conclusion

Selecting the right commercial property lender is a decision that requires careful consideration of several key qualities. Transparency, competitiveness, flexibility, reputation, and support are essential criteria that can guide borrowers towards a fruitful partnership with their lender. By prioritizing these qualities, investors position themselves for success in the dynamic world of commercial real estate.

FAQs

- How do I choose a commercial lender?

Start by evaluating lenders based on their transparency, interest rates, loan flexibility, reputation, and additional support services. Research and compare to find a lender that aligns with your specific needs and investment goals. - Why should you choose a commercial lender over a bank?

Commercial lenders often offer more specialized services, tailored loan structures, and potentially more competitive rates for specific types of investments compared to traditional banks. - What credit score do commercial lenders use?

Unlike personal loans, commercial lending decisions may consider the creditworthiness of the business, including its credit score, financial health, and operational history. However, personal credit scores of the principals may also be relevant. - What are the pros and cons of commercial banks?

Pros: Often offer a broad range of financial products, potentially lower rates due to their size, and the security of dealing with well-established institutions.

Cons: May have stricter eligibility criteria, less flexibility in loan structuring, and a more impersonal customer service experience.

Follow Me